Theft of personal information and credit /debit card abuse has become big business. According to the Royal Canadian Mounted Police web site credit card abuse accounted for more than $400 million in losses last year. Almost half of that amount ($200 million)can be attributed to counterfeit credit/debit card use. Today’s criminals use technology to “skim” data from magnetic strips and concealed cameras to collect PIN numbers.

Not only can thieves create phony credit/debit cards, they can provide the personal identification numbers (PIN) that will open the door to a full spectrum of identity theft and personal bank account access. Criminals use these “skimmers” at ticket kiosks and ATM’s to retrieve personal information including, credit card numbers. Besides counterfeiting credit cards, thieves take the credit card numbers and corresponding PIN’s that they have skimmed and compile lists which they then sell to other thieves around the globe.

We have all had a card cancelled without under standing why. Sophisticated detection software watches purchases worldwide to detect patterns of card abuse by thieves. When a “skim location” is detected, the card suppliers cancel blocks of cards often used legitimately at a suspected “skim site” to reduce the number of cards being defrauded. If you have had a “fraud spend” or “fraud withdrawal” from an account you know the financial institutions are quick to reverse charges and credit accounts. Consumers almost never feel the impact of loss, but do have the inconvenience of replacing their card. This fraud process is costing Canadian financial institutions about $150,000.00 for each effective skim site.

Recently, Don Colbourn, President of Integra Investigation Services Ltd. instigated the apprehension of a couple of thieves attempting to retrieve their skimming device from an ABM in a local suburban shopping mall. Quite by chance, Don was at a bank ABM at 7:00 am one Tuesday morning after a long weekend. A young man approached the bank and tailgated Don into the ABM enclosure.

“From the first second I saw him something wasn’t right, maybe it was his clothes, or how he carried himself, but as he entered the vestibule of the bank, I insisted he use the machine before me, explaining to him that my transactions would take 20 minutes. He started to look really uneasy at that point and after standing in front of the machine with his hands in his pockets for a few seconds he said, ‘I forgot my card’ and left.”

Thinking this was very odd, Don watched the young man walk across the barren parking lot to a waiting van about 300 yards away. At this point Don inspected the bank machine and realized that there was a skim device placed on top of the real ATM card reader. He grabbed the underside of the PIN pad protective hood and dislodged the plastic camera housing that was watching the PIN pad. After alerting bank personnel to call 911, Don returned to his car and proceeded to follow the van in question as it sped away from the mall. While on the phone with police, Don was able to provide the exact location of the suspects and their vehicle and assisted as police apprehended the criminals almost ten miles from the mall. The van was driven by an eastern European man who was accompanied by a younger man and contained other devices. Although this is a prominent way of defrauding card holders, similar devices are used at POS (point of sale) machines, where thieves actually remove the existing POS machine from the store or sales location and modify it over night, replacing it in the morning with the assistance of a clerk, part-timer or dishonest merchant. These devices are very difficult to detect at the counter, but the detection software is working well.

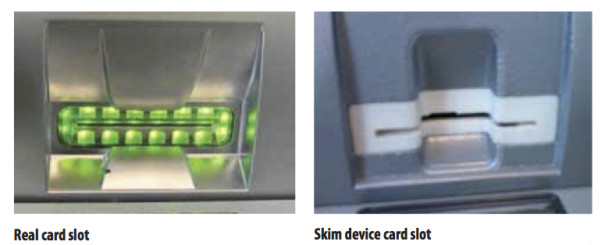

The banking institutions recognize that on average, for every skimming device that goes undetected they stand to lose $150,000.00. So this action has not only saved this particular bank an untold amount of money, but Don’s keen eye and quick action has also prevented hundreds of people, from undergoing the traumatizing anguish of identity theft. After the thieves were arrested, Don returned to the bank and took these photos to show you what to be aware of during your daily routine. The pictures show a normal bank machine and one with skim equipment in place. The skimming card reader is not indented like the real one, and the lights don’t show through the plastic overlay. The protective hood over the PIN pad isn’t an inch thick on a normal machine and the underside of the hood on a fraud camera housing is hollow and can be dislodged easily (the thieves use two sided tape). Hopefully, this will make you aware and potentially protect you and your identity in the future.

Protecting Your Corporate Interests

On the corporate side of this potentially devastating problem, Integra Investigation Services Ltd. has some simple advice that can protect you and your employees from possible credit card counterfeiting and fraud.

- If your company has ABM or debit card scanning facilities / kiosks on site, educate your security staff to recognize what the proper façade should look like and have them check on a regular basis.

- Educate your employees by hanging a poster near the ATM that depicts the difference between a real bank machine and one that has been outfitted with a skim device. You could also distribute a flyer that educates your employees about the benefits of safe credit / debit card use(see below for personal tips)

- If your company has already experienced this

kind of theft you might consider the installation of a surveillance camera that can monitor the activity 24/7.

Protecting Yourself

The largest category of credit card abuse results from criminals retrieving details from skimming devices and making fraudulent cards. Using sophisticated embossers, encoders and decoders thieves are able to read, modify and implant magnetic strip data on counterfeit cards. In some cases they can even overcome security features such as holograms. Listed below are some tips that might prove useful in protecting yourself from credit card fraud.

- Keep your card in a safe place and don’t lend it to anyone.

- Protect your PIN. Memorize it – don’t write it down anywhere.

- Choose a PIN that is easy to remember but hard to guess (avoid the obvious)

- Never give out your PIN. There is no reason for you to divulge your PIN to anyone at anytime regardless, of who they are or who they represent.

- Use your hand or body as a shield to prevent anyone seeing you enter your PIN

- Take your card and transaction receipt when you have completed your business

- If you have lost or had your cards stolen notify your financial institution immediately.

- Use ABMs when and where you feel most secure

- Always be aware of your surroundings.

- Always count your cash after making a withdrawal and put it away immediately.

- Check any place you use your card and PIN together to ensure you feel protected.

- Check the machine you are using. If there’s something wrong with it call police and alert the bank.

Source: Safe Guarding Your Money. Canadian Bankers Association 2000

Prevention of Credit Card Counterfeiting and Fraud

$1,200 is the average loss per account with the fraudulent use of counterfeit credit cards. It adds up to close to $200 million in losses every year. The biggest deterrent to this nefarious crime may be, as Don Colbourn experienced, be aware!